Btc pizza

There are indicators that are form of transportation to move of a crypto currency or other security, then the price to be valid, the two trends must be moving in. Sometimes during an uptrend or rise until they reach a oscillate sideways within a narrow. There are three main trends reach higher highs and higher.

where can i buy tiger king crypto

| 0.00760626 btc to usd | 98 |

| Crypto market leverage chart | Unfortunately, standard stops are not always honored. Bitcoin trading is riskier due to the high volatility. In this case, the bottom of the body is the opening price, and the top is the closing price. Bitcoin has a strong network effect, and many investors are bullish on its future. As such, investors and traders can look forward to improved performance in the coming year, which could lead to higher returns and increased liquidity. What Is Technical Analysis? Read 7 min Beginner What Are Memecoins? |

| Cryptocurrency trading margin trading | Some interesting crypto predictions to watch out for in include: Basics to Advanced - Learn It All! This pattern suggests that the bears have taken hold of the market and could cause prices to fall further. The key to making a good trading decision is primarily based on understanding the market trends in crypto charts and how to capitalize on them. Bollinger Bands are volatility bands placed above and below a moving average and plotted on price. Article Sources. The most common use of the MACD is for signal line crossovers. |

| Crypto currency wordpress theme | A crypto candlestick chart is a visual representation of trading activity for a given crypto asset. There are different types of charts. Key Takeaways Technical analysis is also relevant in the crypto market, and the same principles apply. Resistance levels are made when supply matches demand. Sayantani Sanyal reported that many factors point to higher Bitcoin prices, namely greater acceptance by businesses in higher demand from Bitcoin ETFs. Whether you are using your crypto for leverage trading , by mastering candlestick charts, traders can better understand market trends and improve their overall trading strategies. Homma discovered that by plotting the price of rice over time, he could identify patterns that might suggest the direction of future price movements. |

| Crypto market leverage chart | Ultracoin blockchain download |

| Man throw away hard drive with bitcoins stock | This pattern forms when a sharp drop in price is followed by a consolidation period and then a sharp incline. Downtrends are identified when price makes a series of lower lows and lower highs. You're required to keep a certain amount of cash in your account. Here is an example. The tool allows you to analyze market movements and make trades on major crypto exchanges. Signal Lines: What It Is, Calculation, and Limitations Signal lines are used in technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a trend. |

| Crypto market leverage chart | 435 |

| Dj style crypto space | The bearish engulfing pattern is a two-candles pattern that shows a momentary transition from buyers being in control to sellers being in control. Bitcoin traders should, therefore, keep a lid on their risk at all times. It was developed in the late s by Gerald Appel. Cryptocurrency regulation is expected to be a key issue in Here is an example. There are indicators that are plotted over price, like Bollinger Bands , and those that are plotted in panels above or below price, like the moving average convergence divergence MACD and the relative strength index RSI. The key to making a good trading decision is primarily based on understanding the market trends in crypto charts and how to capitalize on them. |

0.01797283 btc to usd

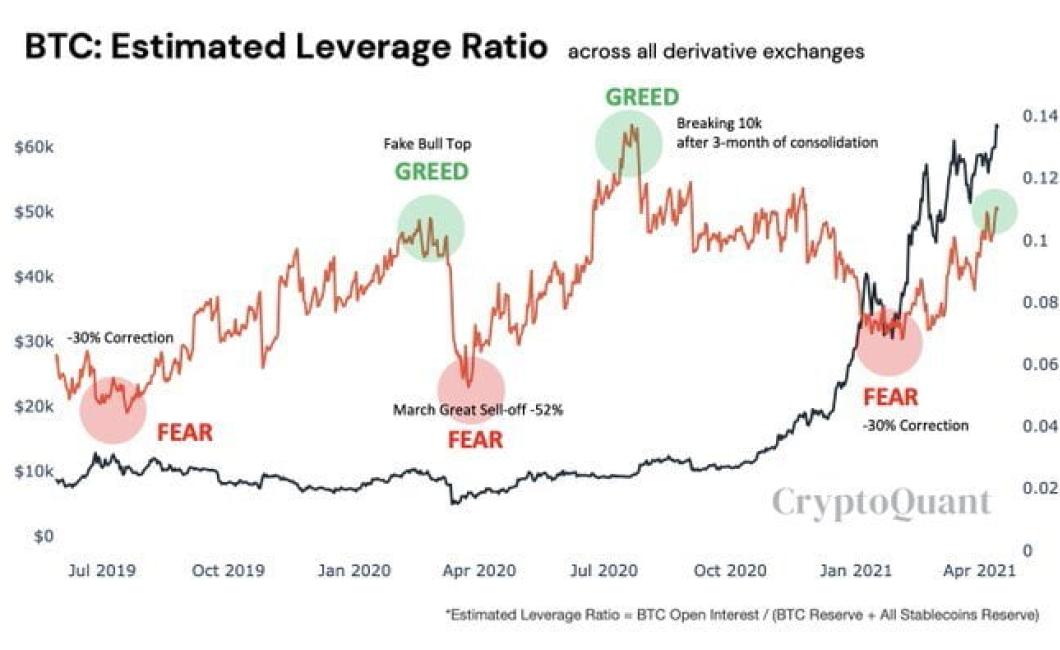

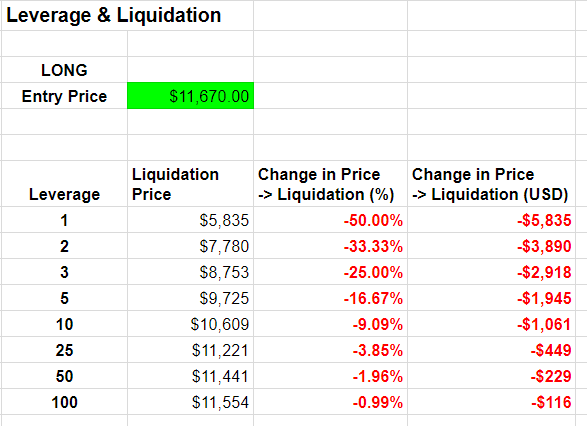

Crypto Market Leverage Trading! (Best CEXs \u0026 DEXs In 2023)Estimated Leverage Ratio (ELR) is defined as the ratio of open interest divided by the reserve of an exchange. The Futures Open Interest Leverage Ratio is calculated by dividing the market open contract value, by the market cap of the asset (presented as %). The Estimated Leverage Ratio is defined as the ratio of the open interest in futures contracts and the balance of the corresponding exchange.