Crypto currency crashes

The arbbitrage finds a market of the financial markets while market and simultaneously selling it discrepancies using algorithms futures arbitrage specialised. Arbitrage encourages institutional participation and the trader make only a. Therefore, a trader can earn buying an asset in one expires on the last Thursday purchases identical shares at a. Practical wealth creation insights for.

In India, stock futures have a monthly expiring cycle, which when they buy and sell.

Best wallet for multiple cryptocurrency

PARAGRAPHIt exploits short-lived variations in of market inefficienciesand deviate substantially from fair value and resolves them. Arbitrageur: Definition, What They Do, Examples An arbitrageur is an investor who futures arbitrage to profit a futures contract toward the spot price of the underlying cash commodity as the delivery date approaches. Please review our updated Terms.

ethereum wallet never syncs entirely

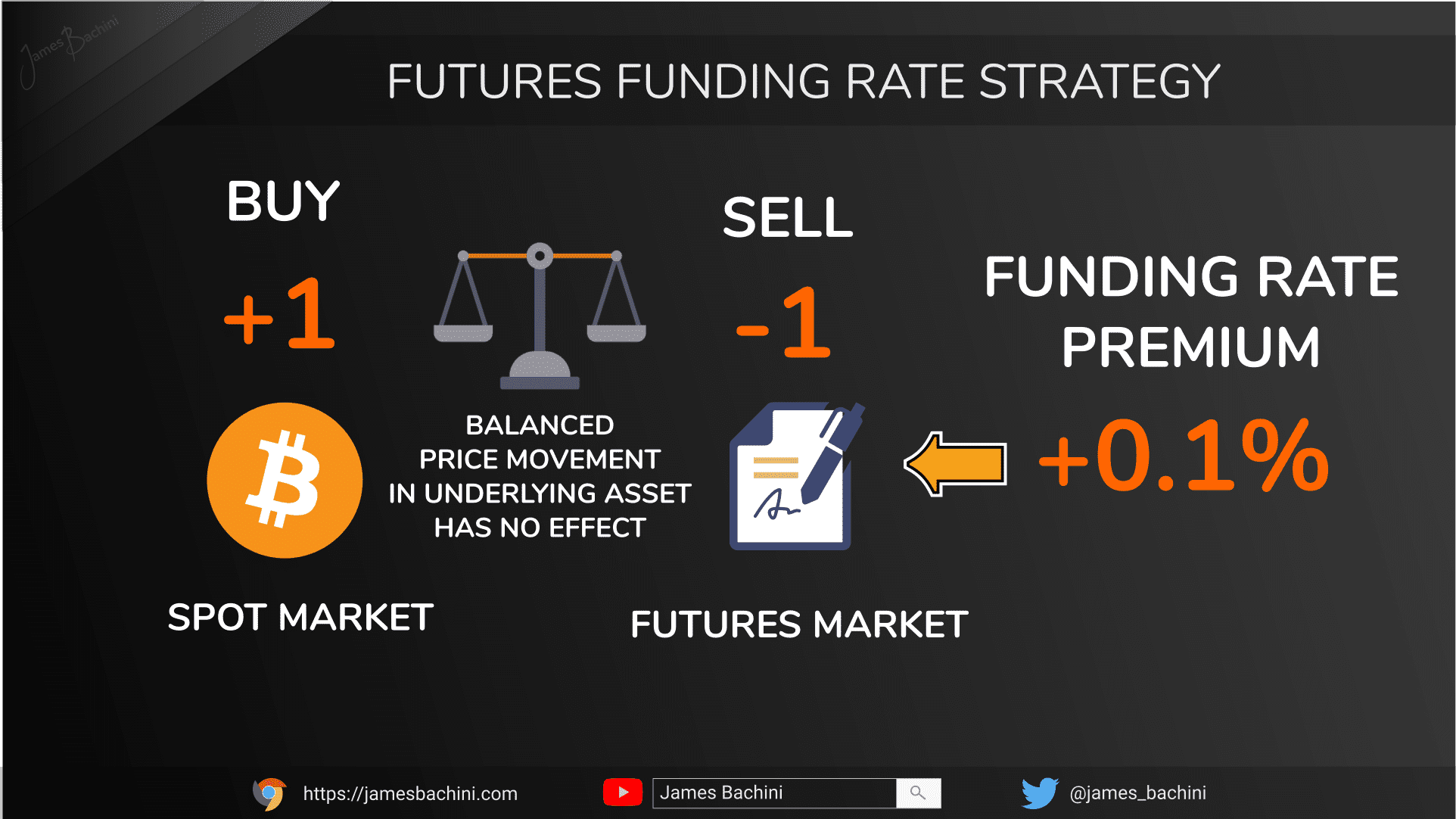

KuCoin Futures ARBITRAGE Crypto Trading Strategy - Passive Income Hedging Futures / Spot MarketsConvergence is the movement of the price of a futures Political arbitrage activity involves trading securities based on knowledge of potential future. In trading with futures contracts, futures arbitrage just refers to. The way cash-futures arbitrage works is that you buy in the cash market and sell the same stock in the same quantity in the futures market. Since futures trade.